What is ESG?

Essentially, sustainability is the ability to maintain a process continuously over time without exploiting resources. This view of responsibility demands business players balance profit with long-term externalities.

With the birth of ESG (Environmental, Social, and Governance) at the turn of the millennium, investors and stakeholders have tangible metrics to determine if a company is sustainable or not. ESG is a framework that investors and other stakeholders use to understand how a company is managing risks and opportunities related to sustainability. While ESG was first used in the context of investing, stakeholders include not just the investors but also a company’s customers, suppliers, and employees, all of whom will be impacted by a company’s operations.

While the focus on sustainability through ESG principles continues to gain momentum globally, a crucial question arises: What about startups? This begs the question of not only whether ESG is relevant for them but also how they can effectively implement it into their operations.

Why is ESG important for startups?

Just as learning a new language is easier for a child than for an adult, startups have a unique opportunity to cultivate their ‘ESG muscles’ right from the start, minimizing the need for massive adjustments later on. Early integration of ESG principles not only streamlines finding product-market fit but also increases a startup’s overall resilience and sustainability.

During the early stage of a company, startups invest significant time in refining their products or services, establishing a customer base, and generating revenue or traction. East Ventures provides multi-stage investments, from Seed to Growth stage investments, for over 300 tech companies across Southeast Asia.

East Ventures is committed to fostering a culture of responsible investing that drives meaningful systemic change. Through our Sustainable Investment Framework, we minimize adverse environmental and social risks while enhancing corporate governance within our portfolio companies. Our dedicated ESG team also plays a critical role in integrating this framework into our investment processes. For us, this is the very baseline that serves as the foundation for all our investment decisions.

Our framework of “Doing Good”—leveraging opportunities and “Avoiding Harm”—risk mitigation is emphasized throughout the entire investment cycle. This is to ensure consistency at every step of our operations.

We understand and recommend different approaches to ESG implementation for startups according to their growth stages and verticals. While full ESG implementation is not a mandatory focus at this phase, we have seen a flourishing number of early-stage startup founders who recognize the value of ESG in gaining a competitive advantage.

Implementing ESG practices early-on offers long-term benefits for startups. Beyond enhancing brand reputation and attracting quality talent, it also equips startups with the tools to effectively manage risks. This forward-thinking approach not only boosts business performance and survival rates but also opens doors to strategic partnerships and funding opportunities.

How can startups start implementing ESG?

1. Engage with stakeholders

Engaging with investors and stakeholders will be a way for startups to communicate their intention to implement ESG. East Ventures has developed a Sustainable Investment Framework to assess and monitor our portfolio companies.

Our Investment and ESG teams can work with startups to develop an ESG and impact implementation roadmap specifically tailored and relevant for their business, starting with providing a guideline for compliance and helping startups set and achieve ESG and impact metrics and goals on a reasonable timeline.

2. Identify ESG risk factors

Startup founders should map out the ESG risk factors related to their businesses and the industry in which they operate. These material ESG risks often overlap with financial risks and should be prioritized. We advise founders to build their companies’ ESG capacity and reassess risks as the company grows.

Good corporate governance and business integrity practices are essential to be embedded by founders and management teams early. For example, complying with applicable laws and regulations, aligning with good standards of transparency and disclosures, developing whistleblowing mechanisms, and enhancing the protection of cybersecurity and data.

This makes an essential early step to ensure startups’ corporate governance best practices can withstand rigorous examination by investors who are increasingly more conscious today; and particularly to prevent “bad” habits from becoming ingrained within the company.

3. Identify ESG-related opportunities

In addition to ESG risks, startups can identify potential opportunities, a process that will be beneficial to find their product-market fit. Once high-level ESG opportunities are identified, startups can engage with investors and stakeholders to act on them.

For instance, we facilitated collaboration between waresix, an end-to-end integrated solution to logistics challenges, and GoKomodo, an agriculture supply chain platform, with corporations to offer efficient logistics solutions for the distribution of agricultural products on a larger scale.

What does a sustainable company look like?

After following these steps above, startups can grow into a sustainable company, effectively integrating ESG considerations into its core business strategy and decision-making.

- Environment: A sustainable company prioritizes environmental stewardship by implementing practices that minimize its ecological footprint and mitigate environmental risks.

This may include adopting renewable energy sources, reducing waste and emissions, and sourcing products from fair-trade organizations to minimize negative impacts on the environment.

- Social: In terms of social responsibility, a sustainable company actively engages with its stakeholders, including employees, customers, suppliers, and local communities.

It invests in employee well-being, diversity, and inclusion initiatives, fosters positive relationships with customers based on trust and transparency, and contributes to the social and economic development of the communities in which it operates.

- Governance: Governance refers to how an organization is led and managed. In a company with good governance, leadership incentives are aligned with stakeholder expectations, shareholder rights are viewed and honored, and internal controls are in place to promote transparency and accountability.

Companies can measure their ESG metrics and progress towards ESG goals, and present them in a Sustainability Report to their stakeholders, also known as ESG reporting.

The practice of disclosing ESG metrics and progress in a Sustainability Report enhances transparency and accountability, using global ESG reporting standards as guidance, such as the GRI (Global Reporting Initiatives), SASB (Sustainability Accounting Standards Board), and the TCFD (Task Force for Climate-related Financial Disclosures) frameworks.

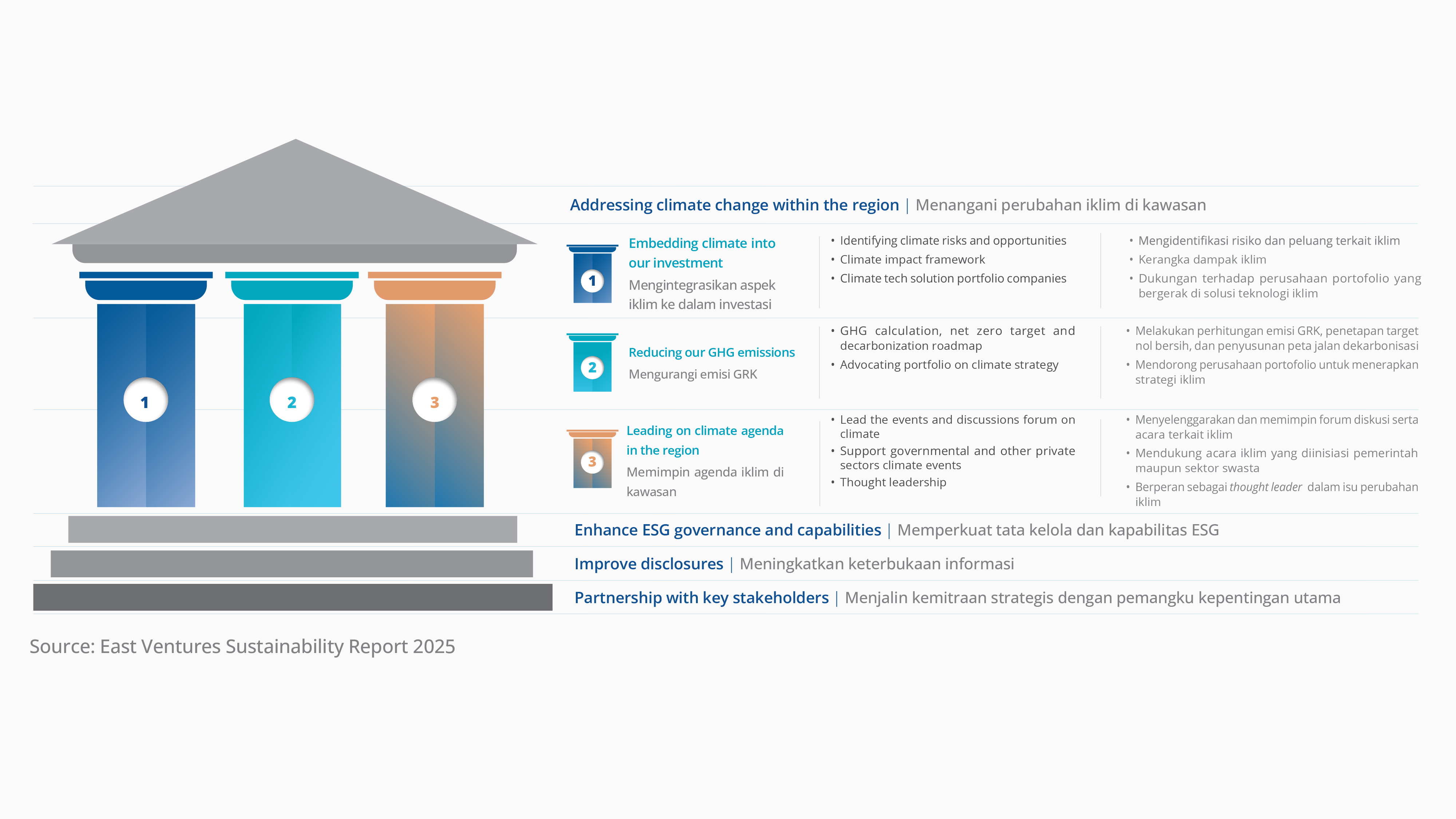

East Ventures released its first Sustainability Report in 2022 and recently launched the fourth edition of the East Ventures Sustainability Report for 2025. This year, the report features the East Ventures Climate Strategy to take a stride further towards addressing the pressing climate challenge within the region. This strategy is built upon three core pillars: Embedding climate into our investment, reducing our GHG emissions, and leading the climate agenda in the region.

Doing the work of ESG reporting for a Sustainability Report serves as a critical tool for not only showcasing our efforts but also helps us track and realize the positive impacts we envision for our firm and the entire ecosystem of startups and partners.

This article is a summary of insights from East Ventures’ interview in Kompas CEO Talks, with additional insights from ESG Specialists at East Ventures.