Indonesia is expected to see a deceleration in its digital economy growth in the coming years, in line with other emerging countries in the ASEAN region, as tech companies in the bloc face pressure to shift to profitability after years of focusing on growth.

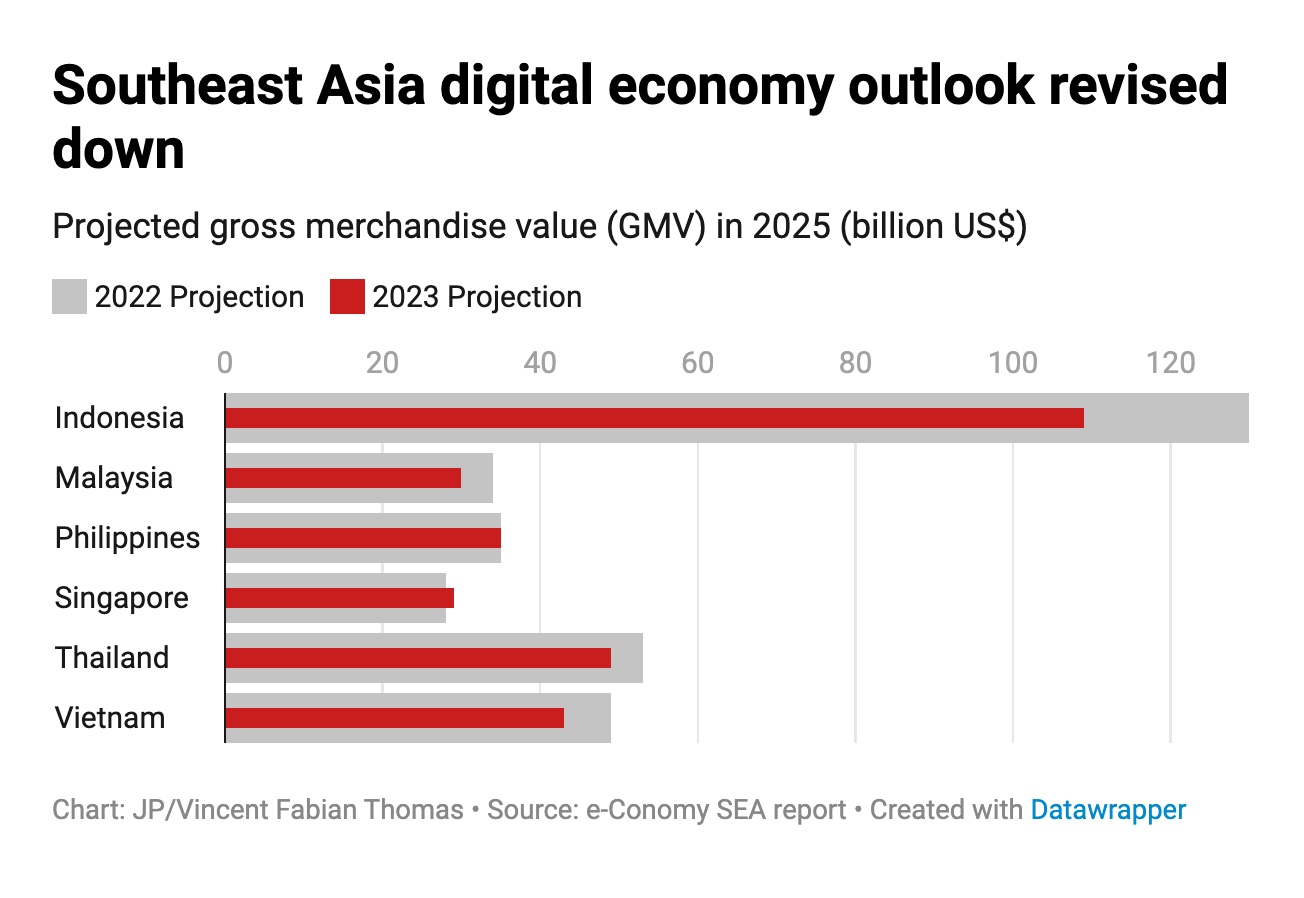

The country’s digital economy is projected to reach US$109 billion in gross merchandise value (GMV) in 2025, according to the annual “e-Conomy Southeast Asia” report published on Nov. 1 by tech giant Google, Singapore-based Temasek and the United States-based research firm Bain & Company. That figure was lower than the US$130 billion projected for the same period in last year’s report.

*East Ventures is a contributor of the e-Conomy SEA 2023 report and its preceding editions.

Similarly, Southeast Asia’s GMV is projected to hover at US$295 billion in 2025 according to the report, a decline from the US$330 billion estimated in the previous report.

GMV typically serves as a key indicator for assessing the health of the digital economy sector, as revenue depends on fees charged upon merchandise sold in a given period of time.

[…]Indonesian economic growth is projected to hover at 4.9 percent in both 2023 and 2024, much slower than the 5.3 percent last year, according to World Bank data.

[…]Funding challenges

Southeast Asia’s private funding hit a six-year low amid high capital costs and increased pressure to shift into a profitability pathway, among other factors.

In the case of Indonesia, funding in the country nosedived across all stages by 87 percent year-on-year to about US$0.4 billion in the first half of the year.

“We believe the funding trend has stabilized at the baseline. It’s important to closely monitor global leaders, especially in the US, to assess whether the market is bottoming out or flattening in,” East Ventures managing partner Roderick Purwana said on Thursday.

Southeast Asia funds had demonstrated notably lower return rates when measured with the paid-in capital investors have made, suggesting difficulty in generating returns for investors, as per the report.

For funds launched between 2016 and 2018, the region yielded a 4 percent return on invested capital, compared with 40 percent in the US, 20 percent in Europe, 10 percent in India and 50 percent in China.

Roderick, with a history of investing in the Indonesian market since 2009, noted that “it’s no longer surprising” for investors to witness low returns, but if measured in internal rate of return (IRR) terms, the baseline is still relatively high.

About 40 percent of East Ventures’ growth portfolio companies had positive earnings before interest, taxes, depreciation and amortization (EBITDA), he said, adding several portfolios have exhibited clear paths to profitability beyond 2025.

The full article was published in The Jakarta Post, Friday, 10 November 2023, page 1 and 11.