Qapita, a Singapore-based equity management platform, has experienced significant revenue growth but also larger losses in its most recent financial year.

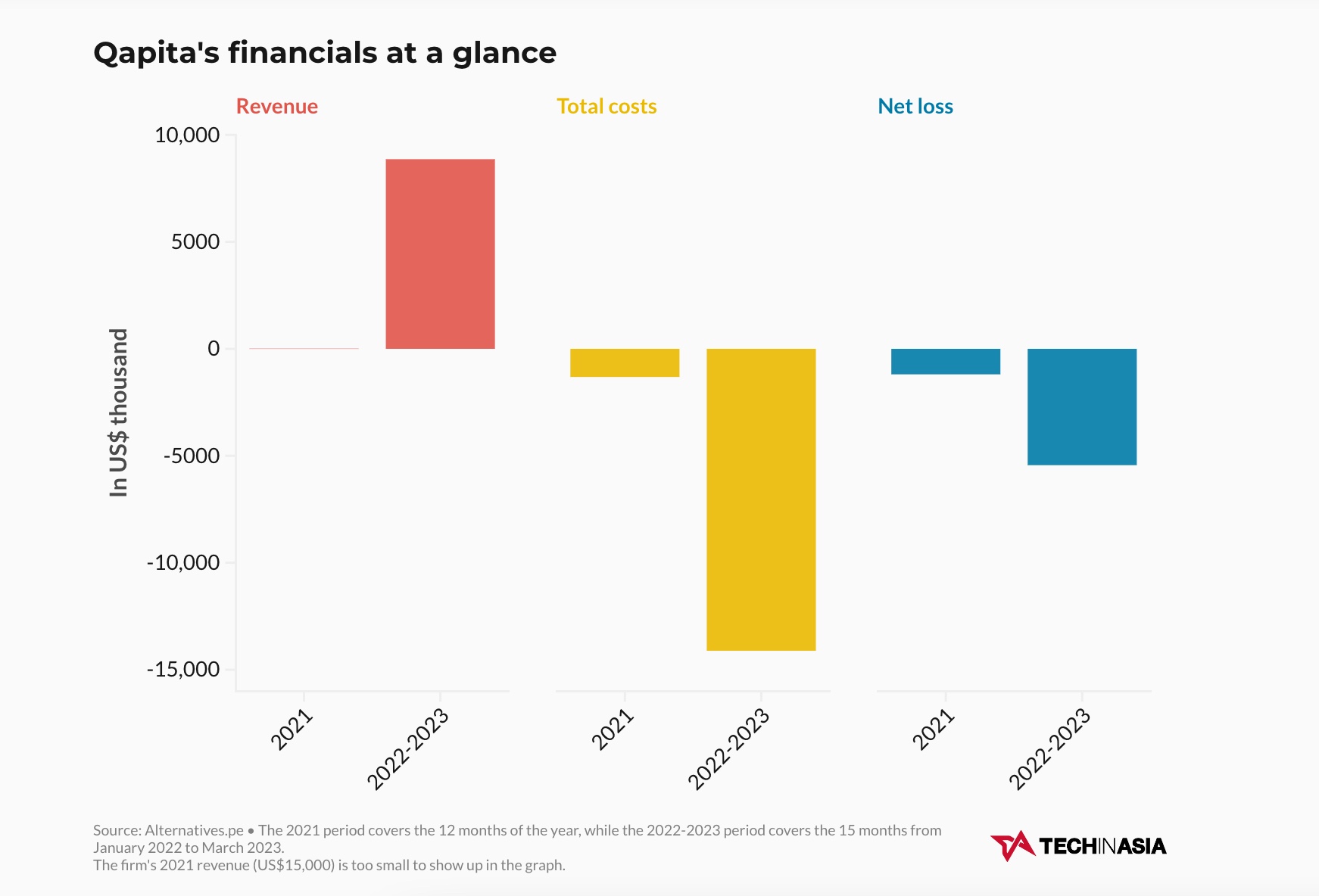

The East Ventures-backed company’s revenue reached US$8.9 million in the 15-month period between January 2022 and March 2023 (FYE 2023). This is a sharp increase from its earnings of just US$14,800 for 2021, according to Alternatives.pe, which tracks regulatory filings in Singapore.

At the same time, Qapita’s total costs stood at US$14 million in FYE 2023, an over 10x surge compared to 2021. This led to a post-tax operational net loss of US$5.4 million for the most recent period.

Led by Ravi Ravulaparthi, who founded the company in 2019 along with Lakshman Gupta Kanamarlapudi and Vamsee Mohan Kamabathula, Qapita provides capitalization table and employee stock ownership plan (ESOP) management services, with clients from over 40 countries. It also has offices in India and Indonesia.

Speaking with Tech in Asia, Ravulaparthi says much of the company’s revenue comes from its equity management services, comprising 80% in the 2023 calendar year. The rest comes from its marketplace, which facilitates transactions in private market securities.

He adds that the revenue growth in FYE 2023 was a result of the company becoming a market leader in India, with 45% of unicorns in the country using Qapita’s products.

The ESOP Direct takeover

Qapita competes with both regional and global players, including Mumbai-based Trica and Australia-based Cake Equity.

In July 2022, Qapita acquired Indian stock plan management firm ESOP Direct, allowing the former to scale significantly. This has translated into the Singapore-based startup’s top-line growth.

“Before the acquisition, we were very small,” says Ravulaparthi. “The acquisition also helps us in terms of fighting competition in the Indian market.”

The combined entity of Qapita and ESOP Direct has over US$12 billion in employee equity under management, reaching 130,000 employee owners.

Given that ESOP Direct primarily serves listed companies, the acquisition allowed Qapita to oversee capitalization tables and ESOPs across the spectrum, from early-stage startups to post-IPO enterprises.

To date, Qapita has served more than 1,900 private companies and over 100 listed firms, surging from the 1,200 customers it reached after the ESOP Direct purchase. Among its clients are Singapore-based MSME lender Funding Societies, Indonesian healthtech platform Halodoc, and Indian grocery delivery app Zepto.

Moreover, Qapita’s LinkedIn page says the firm has 324 employees. Following the ESOP Direct deal, its headcount was at around 220.

On its balance sheet, Qapita recorded goodwill on consolidation amounting to US$17.9 million, likely associated with the acquisition.

Profitable by March 2025

As of March 2023, Qapita had a cash reserve of US$13 million, in contrast to the US$1.8 million worth of cash used in operations.

The full article was published on Tech in Asia, 7 March 2024.